On The Failure to Tame Complexity in Post-PC Devices

The world is crying out for decent post-PC smart devices. In response the industry is producing terrible products that would never see light of day in any other product category.

How do we know the world is crying out for decent products? The iPad. In 15 months the iPad was making more money for Apple than their entire Mac business. This is unbelievable. The iPad is a very nice product, but it isn’t that great. More accurately, it is good. And almost everything else is abysmal.

Abysmal, in that return rates for tablets are routinely measured in double digits. In that most products ship with egregious bugs that we would never tolerate in other product categories (and that are often magically solved in a software update). In that many products ship with performance issues that clearly make them unusable in their primary use case (e.g. phones with less than a day of usable battery life). And perhaps most of all, in that even the simplest tasks are hard to perform by all but the most expert of users.

Why is this happening? For decades the industry has been producing good PCs. They aren’t perfect, but most people buy a PC and get good use out of it for a quite a long time. Why are phones and tablets so different?

The Last Universalist

Consider the following: Every single engineer at Microsoft could go home tonight and build a PC from components, install an OS and give it to their parents. It would work and it would be useful. Mom and Dad would do email and browse the web and occasionally call the engineer for some simple tech support.

In contrast, not a single engineer at Microsoft could go home and build a phone. Forget for a moment the major issue of getting the components. Let’s say one could pick up everything you needed at Fry’s, including the enclosure. I’m saying that not a single engineer has all the skills and knowledge required to build a phone that a consumer would actually use.

I used Microsoft engineers in my example, but the same thing could be said of Apple engineers, Facebook engineers, Google engineers, and probably every engineer in the Valley. The point? There is a massive difference in complexity between a phone and a PC. No-one you know can build a phone. No-one you know can help you to fix one. You’re more likely to have a person in your family that can fix your BMW than you are to have one who can fix your Droid.

Now, part of the reason our engineer can’t do this is an issue of packaging. Phones are smaller and a lot of engineering goes into jamming all that electronics into such a small space. But that is only part of the story. We know this because few companies seem capable of making a good phone, or a good tablet, or even a good set top box. The real story is that the internal complexity of our post-PC smart devices is out of control.

This makes me think of Henri Poincaré, a 19th century mathematician. He was considered to be the Last Universalist, that is, the last human being who was considered to have excelled in all fields of the discipline. I remember the moment I became aware of this because the thought that mathematics had grown to a point where individuals could only ever hope to grasp a piece of it was fascinating and a little scary. Think about that. As we learn more and more about math, it doesn’t get simpler, it gets more complex. The more progress we make, the less any individual understands of the whole. At the same time, our increased collective understanding allows us to build more and more complex things. There’s the scary. None of us understands these new wonders completely.

Even we make our products more simple for users, they get more complex inside.

The PC: Simplicity through Standards, by Mistake

Although the PC is an extra-ordinarily complex object, an historical anomaly made it simple. A standardized architecture with well defined interfaces emerged, creating uniform, industry-wide abstractions that tamed the inherent complexity of a computing device.

This wasn’t intentional. From IBM’s perspective, it was a series of incredible missteps in business strategy and managing their IP that allowed one company to create a uniform software platform and several others to copy their way to greatness with hardware clones. By mistake, the PC became a seldom achieved win-win outcome in a game of prisoner’s dilemma.

And to prove that lightening does strike the same place twice, we have the Internet as a second historical anomaly.

As fantastic as the win-win results of the PC and the Internet were for everyone involved, even IBM, we are unlikely to see this happen again in our lifetimes. The steady state outcome for prisoner’s dilemma, after all, is lose-lose. In this context, lose-lose means that companies generally fight to keep advantage through proprietary technologies and interfaces, and we never see the massive forward momentum that is generated for the industry as a whole when win-win open standards emerge.

But in the lose-lose outcome, most consumer electronics products are internally a complex, proprietary mess. One of the hidden benefits of an open standard is that it stops talented, well meaning engineers from reinventing interfaces to make them slightly better. Even if internal standards exist, few companies have the discipline to hold to them, so much of the complexity is reinvented for every product cycle. Not because engineers and management are bad, but because they are ambitious and unconstrained.

Solution 1: Forcing the Standard

Is Android, an open-ish platform, the answer in the quest for standards when it comes to phones? Not really. It is a software standard of sorts, but the standard runs only skin deep. There is no corresponding hardware standard (e.g. no equivalent of the PC BIOS) that constrains hardware design. Instead, every new phone has its own “board support package”, a non-standard layer of software than tries to abstract away hardware differences. Then the OS must also abstract away more differences. The result is compromised performance and compromised reliability.

Of course, the sheer number of new Android based phones will probably generate some really good ones along the way. But it would be surprising to see any of these individual examples become great product lines that stand the test of time.

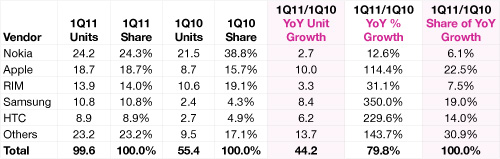

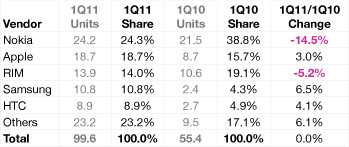

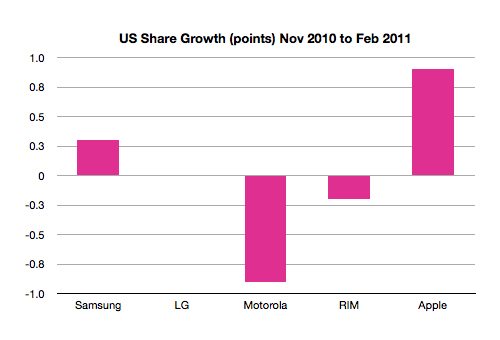

Windows Phone 7 does better than Android at taming complexity by being more restrictive on hardware, but until WP7 has market scale, this just means that phone OEMs will focus on Android as their primary vehicle for differentiation. WP7 will stay a side project. Hence Microsoft’s need to do a huge deal to get Nokia’s full attention. If they can leverage this into scale, then they might be able to use that scale to create some hardware standards. This is the scenario where Microsoft makes an incredible comeback. It isn’t likely, but it is possible and it is the reason that ruling them out completely is short sighted.

Solution 2: An Obsession with Simplicity

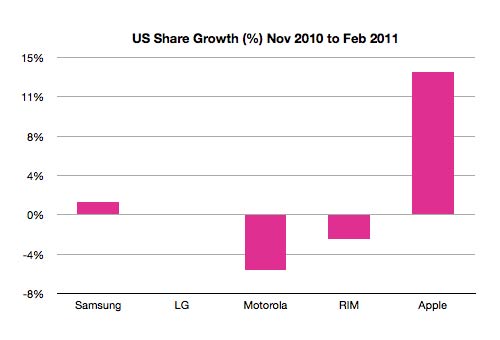

Apple masters the complexity through an incredible discipline of simplicity at the product line level. Any other company would, by now, have diversified the iPhone’s success into a proliferation of SKUs. Just consider the number of times since the iPhone’s launch that smart people have been predicting smaller iPhones, bigger iPhones, iPhone Nanos, iPhone shuffles. It never happened. Why? Apple understands the role of product line simplicity in taming engineering complexity.

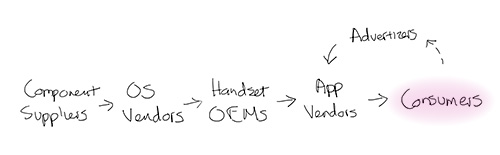

I should also point out that although I have focused on engineering complexity, this is really only part of the picture. Business complexity is arguably just as important and debilitating, particularly in an industry where players like mobile operators, content providers, and the distribution channels have colliding business models that are all in various stages of disruption. But just as product line simplicity helps to Apple tame engineering complexity, it helps them to deal with business complexity. With a single popular product, Apple could out negotiate these other players in ways that OEMs like Nokia and Samsung could never do with larger, but fragmented product lines.

Other companies will get there in time with Apple’s soup to nuts approach. Google might do so by digesting Motorola Mobility and becoming more like Apple. Perhaps completely new OEMs, like Amazon, will emerge and join Apple in replacing the old guard. After all, the bar is so low that even Barnes & Noble can create a credible competitor to the current line-up of products in that market so well-loved by analysts — tablets sans iPad.

And Apple’s continued success is anything but certain. They could so easily lose their way and let the complexity sneak in, especially in a competitive environment where the bar is so low. Hopefully Steve Jobs’s unique understanding of the importance of simplicity at every level is so ingrained in Apple’s culture that it survives his passing.

The reality is that for the next decade there will be some good products from Apple, some isolated brilliance from other manufacturers, and for the rest, a sea of crappy products to choose from. What a perfect time for hardware-savvy startups to make a comeback.

Posted: February 18th, 2012 under Mobile.

Comments/Pingbacks/Trackbacks: none